Originally published March 8, 2015 in The Wall Street Journal

By Robert Rosenkranz

The economist’s book caused a sensation last year, but now he says the redistributionists drew the wrong conclusions.

‘Capital in the 21st Century,” a dense economic tome written by French economist Thomas Piketty, became a publishing sensation last spring when Harvard University Press released its English translation. The book quickly climbed to the top of best-seller lists, and more than 1.5 million copies are now in circulation in several languages.

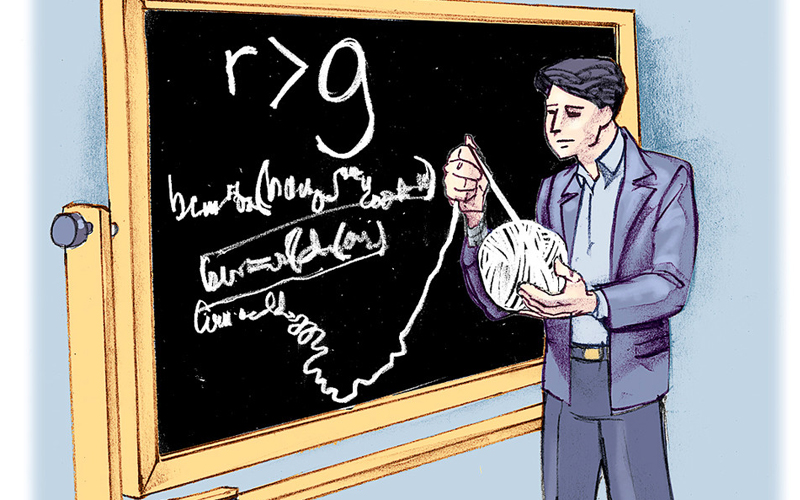

The book’s central proposition, that inequality in capitalist societies will inevitably grow, can be summed up with a simple equation: r>g. That is, the return on capital (r) outpaces the growth rate of the economy (g) over time, leading inexorably to the dominance of inherited wealth. Progressives such as Princeton economist Paul Krugman seized on Mr. Piketty’s thesis to justify policies they have long wanted—namely, very high taxes on the wealthy.

Now in an extraordinary about-face, Mr. Piketty has backtracked, undermining the policy prescriptions many have based on his conclusions. In “About Capital in the 21st Century,” slated for May publication in the American Economic Review but already available online, Mr. Piketty writes that far too much has been read into his thesis.

Though his formula helps explain extreme and persistent wealth inequality before World War I, Mr. Piketty maintains, it doesn’t say much about the past 100 years. “I do not view r>g as the only or even the primary tool for considering changes in income and wealth in the 20th century,” he writes, “or for forecasting the path of inequality in the 21st century.”

Instead, Mr. Piketty argues in his new paper that political shocks, institutional changes and economic development played a major role in inequality in the past and will likely do so in the future.

When he narrows his focus to what he calls “labor income inequality”—the difference in compensation between front-line workers and CEOs—Mr. Piketty consigns his famous formula to irrelevance. “In addition, I certainly do not believe that r>g is a useful tool for the discussion of rising inequality of labor income: other mechanisms and policies are much more relevant here, e.g. supply and demand of skills and education.” He correctly distinguishes between income and wealth, and he takes a long historic perspective: “Wealth inequality is currently much less extreme than a century ago.”

All of this takes the wind out of enraptured progressives’ interpretation of Mr. Piketty’s book, which embraced the r>g formulation as relevant to debates playing out in Congress. Writing in the New York Review of Books last May, for example, Mr. Krugman lauded the book as a “magnificent, sweeping meditation on inequality.” He wrote that Mr. Piketty has proven that “we haven’t just gone back to nineteenth-century levels of income inequality, we’re also on a path back to ‘patrimonial capitalism,’ in which the commanding heights of the economy are controlled not by talented individuals but by family dynasties.”

The r>g formulation always struck me as unconvincing. First, Mr. Piketty’s definition of r as including “profits, dividends, interest, rents, and other income from capital” conflates returns on real business activity (profits) with returns on financial assets (dividends and interest).

Second, it ignores the basic rule of economics that when supply of capital increases faster than demand, the yield on capital falls. For instance, since the great recession, the money supply has grown far more rapidly than the real economy, driving down interest rates. Returns on government bonds, the least risky asset, are now close to zero before inflation and negative 1% to 2% after inflation. In today’s low-return environment, with the headwinds of income and estate taxes, it becomes a Herculean task to build and transmit intergenerational wealth.

Many mainstream economists had reservations about Mr. Piketty’s views even before he began walking them back. Consider the working paper issued by the National Bureau of Economic Research in December. Daron Acemoglu and James A. Robinson, professors at the Massachusetts Institute of Technology and Harvard, respectively, find Mr. Piketty’s theory too simplistic. “We argue that general economic laws are unhelpful as a guide to understand the past or predict the future,” the paper’s abstract reads, “because they ignore the central role of political and economic institutions, as well as the endogenous evolution of technology, in shaping the distribution of resources in society.”

The Initiative on Global Markets at the University of Chicago asked economists in October whether they agreed or disagreed with the following statement: “The most powerful force pushing towards greater wealth inequality in the U.S. since the 1970s is the gap between the after-tax return on capital and the economic growth rate.” Of 36 economists who responded, only one agreed.

Other critics have questioned the trove of statistical data Mr. Piketty assembled to chart trends in income and wealth in the U.S., U.K., France and Sweden over the past century. Are such diverse data comparable, and have the adjustments that Mr. Piketty introduced to make them comparable distorted the final picture?

After an extensive review, Chris Giles, the economics editor of the Financial Times, concluded in May last year that “Two of Capital in the 21st Century’s central findings—that wealth inequality has begun to rise over the past 30 years and that the U.S. obviously has a more unequal distribution of wealth than Europe—no longer seem to hold.”

Mr. Piketty is willing to stand up and say that the material in his book does not support all the uses to which it has been put, that “Capital in the 21st Century” is primarily a work of history. That is certainly admirable. Now it is time for those who cry that we are heading into a new gilded age to follow his lead.

Illustration by David G. Klein