How Google Works is a fascinating look inside one of the most unique and effective corporate cultures anywhere. If you run a business or aspire to, or if you are starting one, you will almost surely come away with useful ideas.

READ REMARKS....Rosenkranz Remarks

The Blog of Robert Rosenkranz

The Debate Continues: Ban College Football?

by robertrosenkranz on March 23, 2015Star rookie Chris Borland’s retirement is causing reverberations this week, leading many to ask, are football’s risks worth its rewards? In 2012, Intelligence Squared U.S. debated the risks of college football with Malcolm Gladwell, Buzz Bissinger, Tim Green and Jason Whitlock. The debate sold out so quickly and garnered so much pre-debate publicity, even we were taken by surprise. Once again, a growing concern over safety has put football’s future back in the spotlight.

READ REMARKS....Best Business Columns of The Week: A Critic Of Inequality Backtracks

by robertrosenkranz on March 19, 2015Originally Published in The Week, March 21, 2015

Best Columns: Business

By Robert Rosenkranz, The Wall Street Journal

“A critic of inequality backtracks”

French economist Thomas Piketty became the darling of the “redistributionist” crowd when his tome Capital in the Twenty-First Century became a big-think sensation last spring, said Robert Rosenkranz.

Wall Street Journal Op-Ed: Piketty Corrects the Inequality Crowd

by robertrosenkranz on March 9, 2015Originally published March 8, 2015 in The Wall Street Journal

By Robert Rosenkranz

The economist’s book caused a sensation last year, but now he says the redistributionists drew the wrong conclusions.

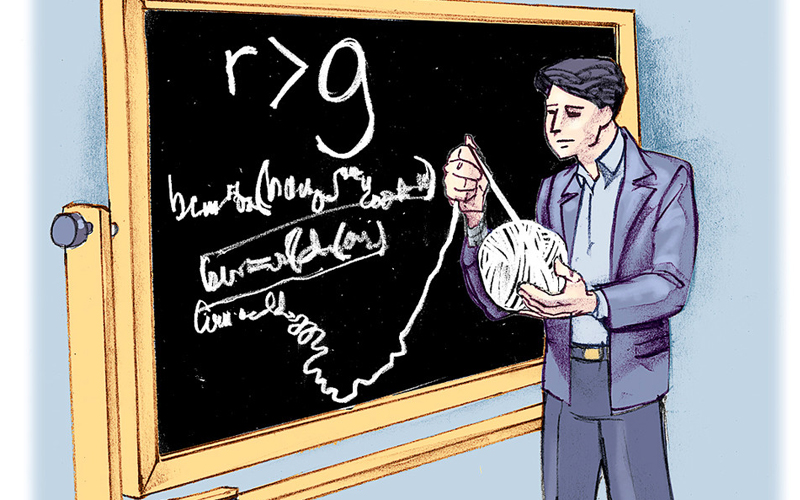

‘Capital in the 21st Century,” a dense economic tome written by French economist Thomas Piketty, became a publishing sensation last spring when Harvard University Press released its English translation. The book quickly climbed to the top of best-seller lists, and more than 1.5 million copies are now in circulation in several languages.

The book’s central proposition, that inequality in capitalist societies will inevitably grow, can be summed up with a simple equation: r>g. That is, the return on capital (r) outpaces the growth rate of the economy (g) over time, leading inexorably to the dominance of inherited wealth. Progressives such as Princeton economist Paul Krugman seized on Mr. Piketty’s thesis to justify policies they have long wanted—namely, very high taxes on the wealthy.

READ REMARKS....Recommended Reading: The Fourth Revolution

by robertrosenkranz on March 2, 2015In 2011, Intelligence Squared U.S. debated the proposition China does Capitalism better than America, which dealt with the success of state capitalism in what is destined to be the world’s largest economy.

Another remarkable success is Singapore, whose model of authoritarian capitalism strikes many leaders in emerging market countries as more compelling than the democratic kind. These success stories, when viewed against the backdrop of an under-performing India, a stagnant Europe, and a sluggishly growing US, raise broader questions about the effectiveness of democratic governance.

I commend an outstanding new book, The Fourth Revolution: The Global Race to Reinvent the State, which deals with just these questions.

The book recapitulates the three great revolutions in governance: the nation state, the liberal state, and the welfare state. It argues that the success of the West has been in its ability to re-invent government, and makes a compelling case that a “fourth revolution” is required to meet the challenges of Asian progress.

Authors John Micklethwait, former editor-in-chief of The Economist, and the new head of Bloomberg News, and Adrian Wooldridge, The Economist’s management editor, make their argument persuasively: you cannot read the description of the China Executive Leadership Academy, where China’s top officials are trained, without being impressed with their prospects and dismayed by our own.

Available here on Amazon.

READ REMARKS....